What You Should Know about Coretax System

What You Should Know about Coretax System

The Ministry of Finance of the Republic of Indonesia (MoF) has issued MoF Regulation number 81 Year 2024 (MOF-81) on the implementation of Coretax System which is effective starting from 1st January 2025 tax period.

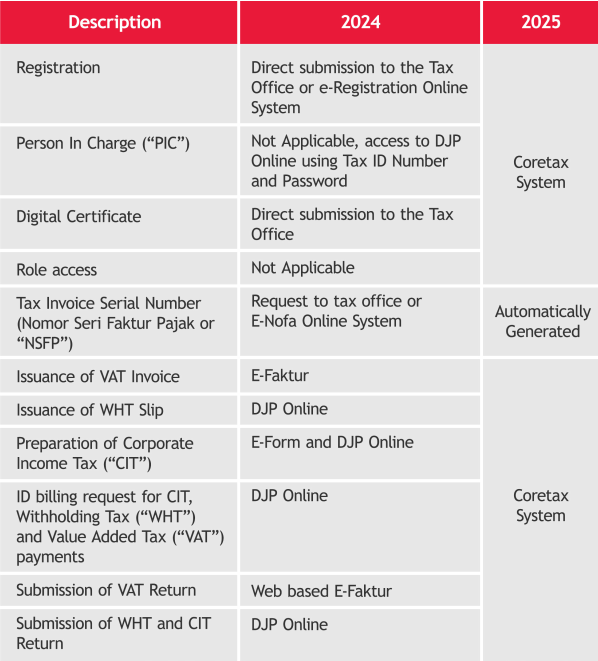

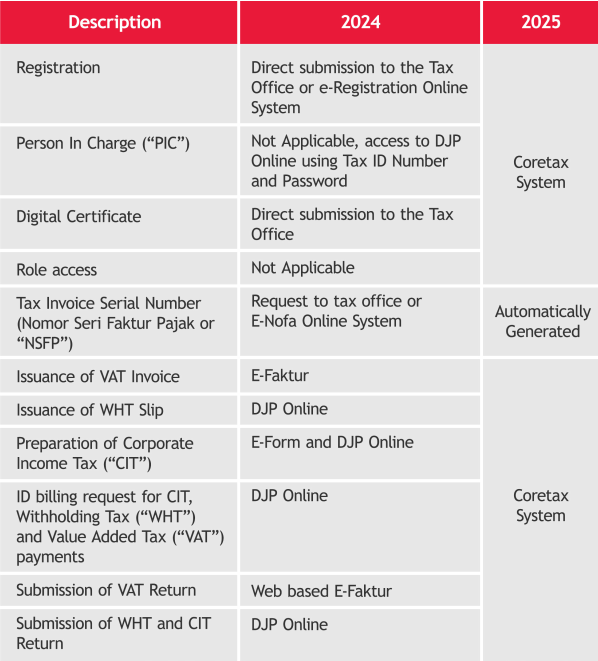

Coretax System is an essential component of the government’s efforts to enhance the efficiency, accuracy, and transparency of tax compliance processes. It provides a centralized platform for Indonesian Taxpayers to fulfill their tax obligations in a streamlined manner, reducing the complexity of tax filing while maintaining easy and transparent access for both taxpayer and tax authority. Here is the brief comparison of the previous online portal with Coretax system for taxpayer consideration:

For the implementation of Coretax System, the following steps need to performed by Indonesian Taxpayer:

Please note that during the implantations of the Coretax System, there are general issues faced by taxpayers regarding accessibility, authorization and features that are continuously developed and updated by the Directorate General of Taxes (DGT). Currently, system improvements are still carried out by the DGT so that the authorized personnel can perform their function to issue VAT invoice, claim VAT credit and issue withholding tax slip so that the main purpose of fulfilling tax obligations through Coretax System can be implemented properly.

Coretax System is an essential component of the government’s efforts to enhance the efficiency, accuracy, and transparency of tax compliance processes. It provides a centralized platform for Indonesian Taxpayers to fulfill their tax obligations in a streamlined manner, reducing the complexity of tax filing while maintaining easy and transparent access for both taxpayer and tax authority. Here is the brief comparison of the previous online portal with Coretax system for taxpayer consideration:

For the implementation of Coretax System, the following steps need to performed by Indonesian Taxpayer:

- Register the company and PIC.

- PIC to obtain digital certificate for tax administrative and reporting purposes.

- PIC may authorize other parties on the access.

Please note that during the implantations of the Coretax System, there are general issues faced by taxpayers regarding accessibility, authorization and features that are continuously developed and updated by the Directorate General of Taxes (DGT). Currently, system improvements are still carried out by the DGT so that the authorized personnel can perform their function to issue VAT invoice, claim VAT credit and issue withholding tax slip so that the main purpose of fulfilling tax obligations through Coretax System can be implemented properly.