Tax Insight: Minister of Finance Regulation No. 131 of 2024

Tax Insight: Minister of Finance Regulation No. 131 of 2024

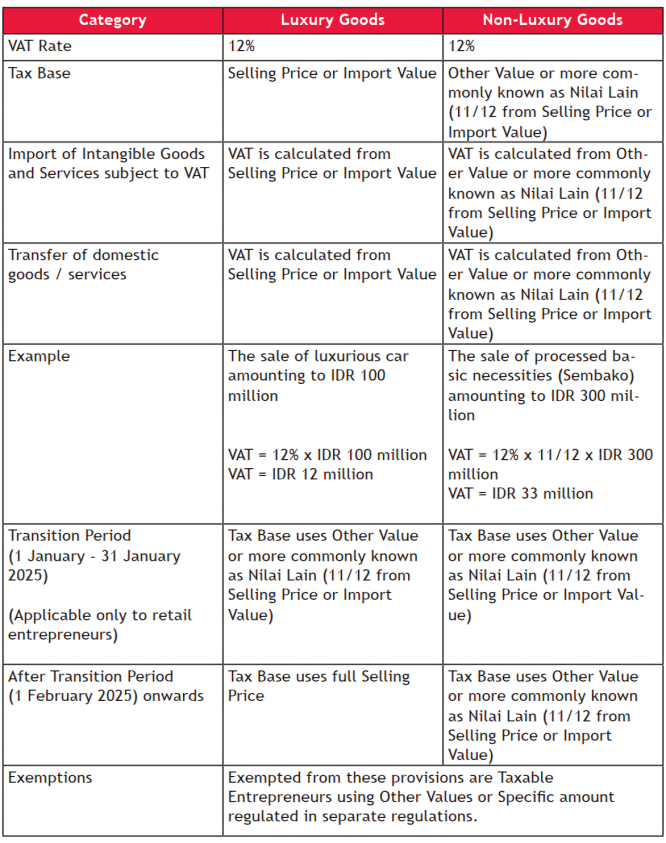

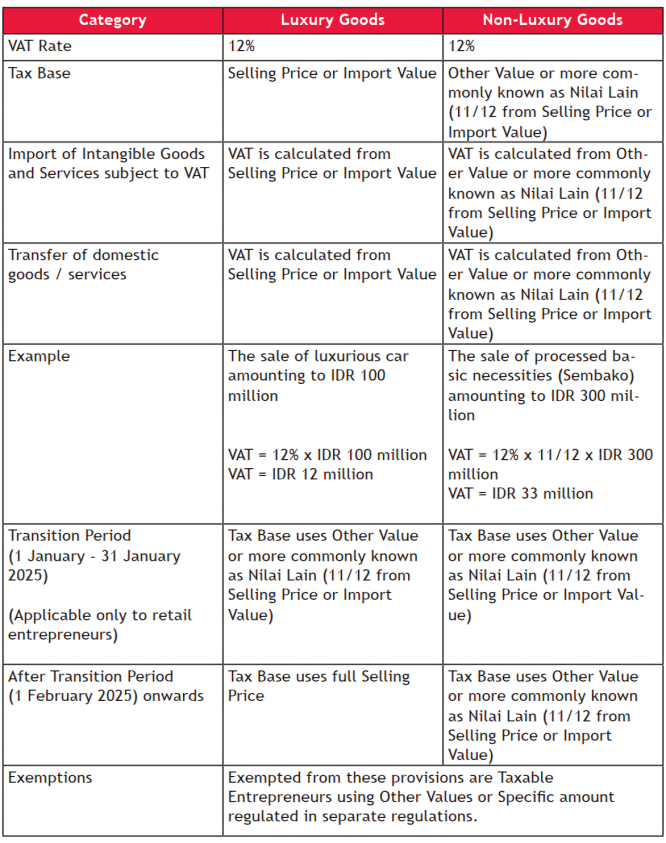

Article 2 of this new MoF Regulation confirms that the new VAT rate is indeed 12%. The Tax Base for calculating the VAT for Luxury Goods1, including motor vehicles and other luxury goods which are subject to the luxury goods tax in accordance with the provisions of taxation laws and regulations is the selling price or the import value.

Regarding non-luxury goods, Article 3 stipulates that the Tax Base for calculating such goods are 11/12 (eleven twelfths) of the selling price, import value, or compensation.

Furthermore, Articles 2 and 3 both stipulate that the VAT of the respective category of goods and services could be credited as Input VAT in accordance with the provisions of laws and regulations in the field of taxation.

Article 4 of this new MoF Regulation stipulates A Taxable Entrepreneur who collects, calculates, and remits the Value Added Tax (VAT) due on the delivery of Taxable Goods and/or Taxable Services with:

For ease of transition from the current VAT rate to the new VAT rate, Article 5 of this new MoF Regulation states that Taxable Entrepreneurs who transfer Luxury Goods to buyers with the characteristics of end consumers is to use 11/12 (eleven twelfths) of the selling price as the tax base from 1 to 31 January 2025. The selling price is to be used as the tax base, as stipulated in Article 2, starting 1 February 2025 onwards.

The new VAT regulations can be summarized as shown in the table below:

.png)

With this new MoF Regulation, it can be confirmed that the effective VAT rate eventually results at the same amount to 11% for non-luxury goods and services. However, on a more technical note, the unique method of increasing the VAT Rate of 12% for all goods and services while simultaneously reducing the tax base using a multiplier of 11/12 has raised concerns. Specifically, there is uncertainty about whether the transfer of non-luxury goods now falls under the DPP Nilai Lain category. If so, this would mean that the Tax Invoice should use the 040 code, rather than the usual codes previously applied.

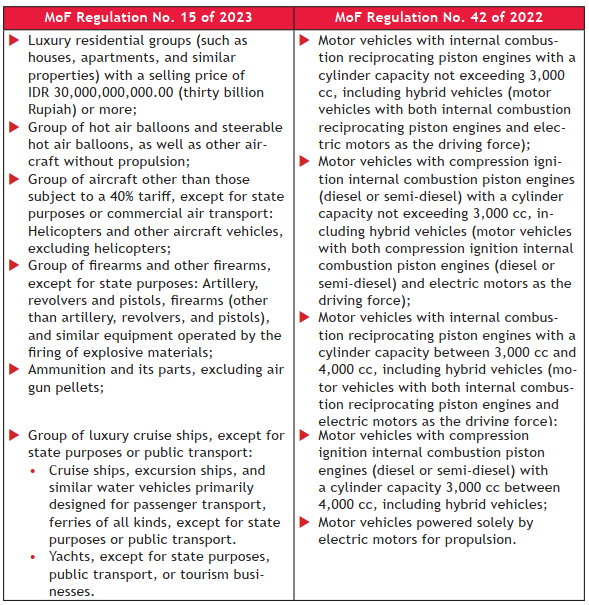

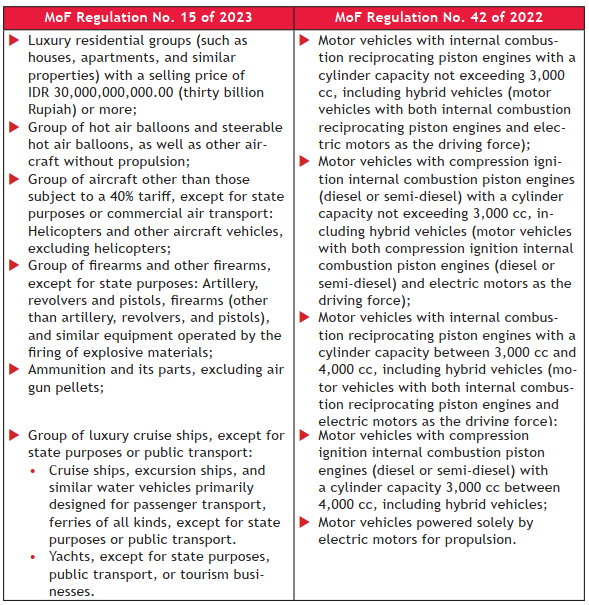

1Other luxury goods mentioned above are regulated further in the attachment of MoF Regulation No. 15 of 2023 & MoF Regulation No. 42 of 2022. In these MoF Regulations, these following goods are categorized as other luxury goods, therefore subject to the new VAT rate with the tax base of its selling price or import value:

Regarding non-luxury goods, Article 3 stipulates that the Tax Base for calculating such goods are 11/12 (eleven twelfths) of the selling price, import value, or compensation.

Furthermore, Articles 2 and 3 both stipulate that the VAT of the respective category of goods and services could be credited as Input VAT in accordance with the provisions of laws and regulations in the field of taxation.

Article 4 of this new MoF Regulation stipulates A Taxable Entrepreneur who collects, calculates, and remits the Value Added Tax (VAT) due on the delivery of Taxable Goods and/or Taxable Services with:

- using a tax base based on other value, the provisions of which are specifically regulated in the tax laws and regulations; and

- a specific amount, the provisions of which are regulated in the tax laws and regulations.

For ease of transition from the current VAT rate to the new VAT rate, Article 5 of this new MoF Regulation states that Taxable Entrepreneurs who transfer Luxury Goods to buyers with the characteristics of end consumers is to use 11/12 (eleven twelfths) of the selling price as the tax base from 1 to 31 January 2025. The selling price is to be used as the tax base, as stipulated in Article 2, starting 1 February 2025 onwards.

The new VAT regulations can be summarized as shown in the table below:

.png)

With this new MoF Regulation, it can be confirmed that the effective VAT rate eventually results at the same amount to 11% for non-luxury goods and services. However, on a more technical note, the unique method of increasing the VAT Rate of 12% for all goods and services while simultaneously reducing the tax base using a multiplier of 11/12 has raised concerns. Specifically, there is uncertainty about whether the transfer of non-luxury goods now falls under the DPP Nilai Lain category. If so, this would mean that the Tax Invoice should use the 040 code, rather than the usual codes previously applied.

1Other luxury goods mentioned above are regulated further in the attachment of MoF Regulation No. 15 of 2023 & MoF Regulation No. 42 of 2022. In these MoF Regulations, these following goods are categorized as other luxury goods, therefore subject to the new VAT rate with the tax base of its selling price or import value: